Latest articles and insights

20/01/2026

Everything you need to know about small event insurance

Protect your event with Marsh's Small Event Insurance Solutions. Fast, easy public liability cover for weddings, functions, tradeshows and more events across Australia.

07/01/2026

Cyber insurance for real estate agents protection guide

Protect your real estate agency from cyber attacks with insurance covering data breaches, ransomware and email fraud. Get quotes from $1,200 annually.

09/12/2025

Insurance market update for accountants

Discover how 2025 market conditions benefit sole practitioners with softer PI premiums, broader coverage options, and tips on how to prepare for your insurance renewal.

17/11/2025

Market Changes Shaping Tradies Insurance Cost in Australia 2025

Stay on top of commercial insurance rates in Australia with insights on SME cover, costs, insurer appetite and renewal tips for tradies.

12/11/2025

Insurance market review – small-medium business in focus

The Marsh Australian mid-year insurance market update is a detailed report that helps insurance buyers stay informed about market dynamics and make strategic decisions

12/11/2025

Market influences and changes for the events industry

Stay updated on 2025 insurance trends for the entertainment and events industry. Learn about market influences, underwriting updates, claims patterns, renewal strategies and tips to improve your coverage and manage risks effectively.

12/11/2025

Insurance market update for real estate agencies

Stay informed with the latest 2025 insurance trends for real estate agencies. Learn about renewal tips and how market changes impact your coverage.

30/10/2025

Civil commotion and cancellation insurance

Protect your event from financial losses as a result of a strike, riot or civil commotion with Marsh Insurance. Learn more.

01/09/2025

Personal accident and sickness insurance for tradies

Personal accident and optional sickness cover for Australian tradies arranged by Marsh. 24/7 injury cover, business expenses and fracture payouts.

28/08/2025

What’s the difference between WorkCover and personal accident insurance

Compare WorkCover and personal accident insurance in Australia. Understand coverage, benefits, eligibility, and how each can protect your income.

29/07/2025

Risk management for 24-hour gyms and fitness centres

Learn how 24-hour gyms can manage risk, prevent incidents, and protect their business with the right insurance and safety measures.

29/07/2025

Swim Schools & CCTV: Smarter Risk Management

Learn how CCTV and strong records help swim schools manage risk, protect staff, and reduce liability claims with better safety practices.

29/07/2025

Is your toolbox complete?

A vital tool in the tool kit every plumber should have is insurance. We have compiled a comprehensive list of all the types of insurance a plumber may need

25/05/2025

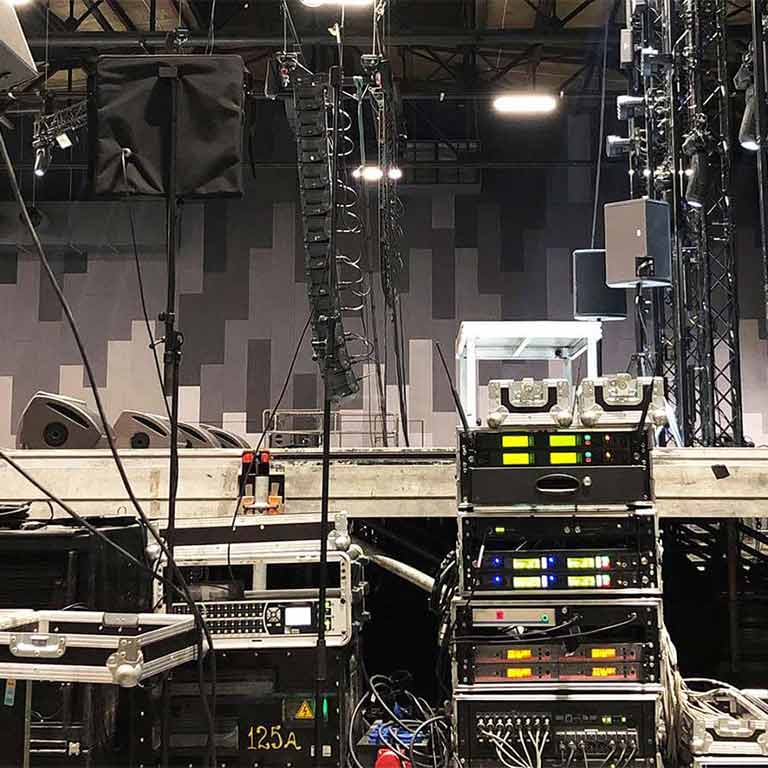

I'm not on stage. Why do I need insurance?

What you need to know about sound and lighting insurance and tips on how to determine what’s right for you including equipment coverage, public liability insurance and professional indemnity insurance.

06/05/2025

Business interruption prepare for weather

Businesses that are prepared for the impact of extreme weather are more able to quickly respond, process their claim and get back to business.

06/05/2025

ISR vs business insurance

industrial special risk vs business insurance: how to tell when you’ve outgrown small business insurance.

06/05/2025

Topics to discuss with your broker

Professional indemnity insurance top questions to ask your broker before purchasing your business insurance – policy working, benefits, limit, run-off cover, back-dating policies and more. Read now.

06/05/2025

3 reasons why directors and officers cannot afford to ignore management liability insurance

D&O insurance cover has limitations which can leave directors and officers exposed. Management liability insurance could offer you comprehensive protection.

06/05/2025

Management liability demystified – is it the same thing as D&O?

Management liability is often confused with D&O insurance. And while the two are similar, there are some subtle differences. Find out in this article.

06/05/2025

How to protect your business from social engineering?

Social engineering poses a significant threat to SMEs. Learn how to protect your business from financial loss, downtime and productivity loss.

06/05/2025

Cyber crime and your business – building your Game Plan

When it comes to cyber crime, preparedness isn’t just for large organisations. What could a cybersecurity incident cost your business?

06/05/2025

Increasing cyber-attacks on Australian small and medium enterprises

What you need to know about cyber attacks on small-to-medium businesses. Emerging cyber threats, the cost of cyber security measures and trends

06/05/2025

Artificial intelligence influences cyber crime

AI-Powered Threats: Exploring the growing influence of artificial intelligence in cybercrime with top tips to defy scammers and protect your business.

06/05/2025

Have you got the right insurance cover to match your business growth?

Is your business growing? A changing business climate often means your insurance also needs to change, and you run the risk of being over- or underinsured.

14/04/2025

Top 10 questions before purchasing personal trainer insurance solutions

Top 10 insurance questions personal trainers ask. Public liability and professional indemnity insurance explained to help you decide the level of cover you need.

11/04/2025

Why sound and lighting techs can't rely on third-party vendors for insurance

Why sound and lighting techs can't rely on third-party vendors for their insurance needs. It can expose their business to additional liabilities should accidents happen. Make sure adequate protection is held to cover third party business risks.

27/02/2025

Stopping tool theft in your business

As a tradie, the tools of your trade are essential. Without them, you can’t run a business, which is why it’s critical to have security measures in place.

03/12/2024

Liability insurance market trends 2024

Find out how your business could be impacted by liability insurance market fluctuations in Australia in 2024. Watch our expert highlights, download our detailed report for liability and other insurance markets.

03/12/2024

Cyber insurance market trends 2024

Find out how your business could be impacted by cyber insurance market fluctuations in Australia in 2024. Watch our expert highlights, download our detailed report for cyber and other insurance markets.

03/12/2024

Property insurance market trends 2024

Find out how your business could be impacted by property insurance market fluctuations in Australia in 2024. Watch our expert highlights, download our detailed report for property and other insurance markets.

28/08/2024

Managing pharmacy business risks

Dispensing errors, stock loss, and cyber risks are common in pharmacies. With 2,000+ covered, Marsh provides a guide to manage these risks.

11/10/2023

Mental health and your business

Mental health affects small teams quickly. Learn how practical support and digital health benefits can help Australian businesses support employee wellbeing.

11/10/2023

Five steps to manage people risk

A simple guide for Australian small businesses on managing people risk, supporting workforce health, and reducing disruption through practical, step-by-step actions.

11/10/2023

Construction insurance market trends 2023

Find out how your business could be impacted by construction insurance market fluctuations in Australia in 2023. Watch expert highlights, download a detailed report for other markets.

11/10/2023

Financial and professional liability insurance market trends 2023

Find out how your business could be impacted by professional indemnity and D&O insurance market fluctuations in Australia in 2023. Watch expert highlights, download a detailed report for other markets.

11/10/2023

Liability insurance market trends 2023

Find out how your business could be impacted by liability insurance market fluctuations in Australia in 2023. Watch our expert highlights, download our detailed report for liability and other markets.

11/10/2023

Cyber insurance market trends 2023

Find out how your business could be impacted by cybersecurity insurance market fluctuations in Australia in 2023. Watch expert highlights, download a detailed report for other markets.

11/10/2023

Liability insurance market trends 2024

Find out how your business could be impacted by liability insurance market fluctuations in Australia in 2024. Watch our expert highlights, download our detailed report for liability and other insurance markets.

20/02/2023

Supporting employee mental health in small businesses

Steps small businesses can take to support employee mental health, manage people risk and build a safer, more supportive workplace.

20/02/2023

Tool insurance for tradies

Stolen tools can cost you thousands. Learn how tool insurance protects tradies from theft, damage, and costly downtime, and how to choose the right policy.

20/02/2023

Professional liability vs general liability insurance Australia

Compare professional liability and general liability insurance for Australian businesses. Know which coverage protects your services vs physical risks.

20/02/2023

Transport and logistics insurance trends in 2025

Transport and logistics insurance in Australia faces rising premiums in 2025 due to claims, driver shortages and repair costs, with tech aiding risk management.

20/02/2023

The importance of tax audit insurance for accountants

With tax authorities increasing compliance activity and expanding audit focus areas, public practitioners should ensure they are adequately protected for the year ahead.

20/02/2023

Bookkeeper risk management: prevent indemnity claims

Avoid costly PI claims with smart bookkeeper risk management. Practical strategies for documentation, client communication and quality assurance.

20/02/2023

What to look for in your commercial truck and fleet insurance broker

Discover the benefits of partnering with a specialist truck insurance broker, from policy selection to claims support. Read our checklist!

20/02/2023

Professional liability cover for CPA accounting firms

Professional Liability Insurance Solutions – a tailor-made cover designed to protect CPA Accounting firms against Negligence, Third-Party Claims, and Cyber Threats.

20/02/2023

The value of working with an insurance broker

We break down the top eight reasons why you should work with an insurance broker for your business insurance and risk management needs.

20/02/2023

The role of cyber insurance when using managed service providers

Marsh cyber insurance for accountants and professionals. Make sure you’re protected. Learn more.

20/02/2023

Minimise the risk of a ransomware attack on your business

Ransomware attacks on small-to-medium businesses are highly prevalent, yet few businesses know what to do to manage this threat. Find out more about ransomware attacks and critical strategies to consider.

20/02/2023

Do I need insurance as a dog walker?

If you are looking to start up your own dog walking business, there are a few things to tick off before taking on your first furry client, one being insurance.

20/02/2023

How breweries can mitigate the risk of machinery breakdown

Here are four key recommendations to consider for your risk management approach to manage and mitigate the potential impact of this machinery breakdown.

20/02/2023

Managing cyber threats to operational technology: learnings from the jbs ransomware attack

How meat producers can mitigate cyber risks associated with new technologies – key challenges and strategies learned from the JBS ransomware attack. Lessons for any business. Find out more.

20/02/2023

Protect Your Business From Cyber Threats

Cyber insurance policies can protect businesses from the financial consequences of cyber crime. Before you invest in a cyber policy there are things you need to know.

20/02/2023

Do you have the right tradies liability insurance for your business?

Tips for tradies who are looking to purchase or renew their tradie business insurance. What to look out for when comparing policies to help save time and money.

20/02/2023

Do pet sitters and boarders need public liability insurance?

Public liability insurance can help cover your pet sitting or boarding business if a pet or someone is injured as well as damages to a persons property.

20/02/2023

Understanding professional indemnity accountants

Professional indemnity insurance is critical for anyone running their own accounting or bookkeeping business. More about why and what to consider to help protect your reputation, business, employees and clients.

20/02/2023

Eight common questions about contract works insurance

To help builders arrange their next contract works policy, we’ve collated answers to the top eight questions our brokers receive about contract works insurance.

20/02/2023

What to look for in professional indemnity cover

As a professional who provides expertise to clients, it’s critical to manage your professional indemnity risk exposure, and help protect your business and clients. How to go about it.

20/02/2023

Renewing your business insurance? Help avoid this costly mistake

How insurance renewals work – what brokers may need their clients to know and when it makes sense to consider working with a specialist business broker.

20/02/2023

Navigating a contract works claim five tips

Navigating a contract works claim: 5 tips to ensure a successful claims experience

20/02/2023

Tips for saving on tradie insurance premiums

Chances are your tradie business has been run off its feet lately, due to a skills shortage in Australia. Here are the top tips to save on your tradie insurance.

20/02/2023

Top risks for the construction industry

From rising costs to the threat of cyber attack, we explore the risks and exposures that can affect builders and building companies.

Marsh Advantage Insurance Pty Ltd (ABN 31 081 358 303, AFSL 238369) (“Marsh”) arranges the general insurance (i.e. not the Discretionary Trust Arrangement) and is not the insurer. This page contains general information and does not take into account your individual objectives, financial situation or needs. For full details of the terms, conditions and limitations of the covers, refer to the specific policy wordings and/or Product Disclosure Statements available from Marsh on request. Marsh makes no representation or warranty concerning the application of policy wordings or the financial condition or solvency of insurers or re-insurers. Marsh makes no assurances regarding the availability, cost, or terms of insurance coverage. Any statements concerning actuarial, tax, accounting, or legal matters are based solely on our experience as insurance brokers and risk consultants and are not to be relied upon as actuarial, accounting, tax, or legal advice, for which you should consult your own professional advisors. The Discretionary Trust Arrangement is issued by the Trustee, JLT Group Services Pty Ltd (ABN 26 004 485 214, AFSL 417964) (“JGS”). Any advice or dealing in relation to the Discretionary Trust Arrangement is provided by JLT Risk Solutions Pty Ltd (ABN 69 009 098 864, AFSL 226 827) (“JLT”). JGS and JLT are businesses of Marsh McLennan. The cover provided by the Discretionary Trust Arrangement is subject to the Trustee’s discretion and/or the relevant policy terms, conditions and exclusions.